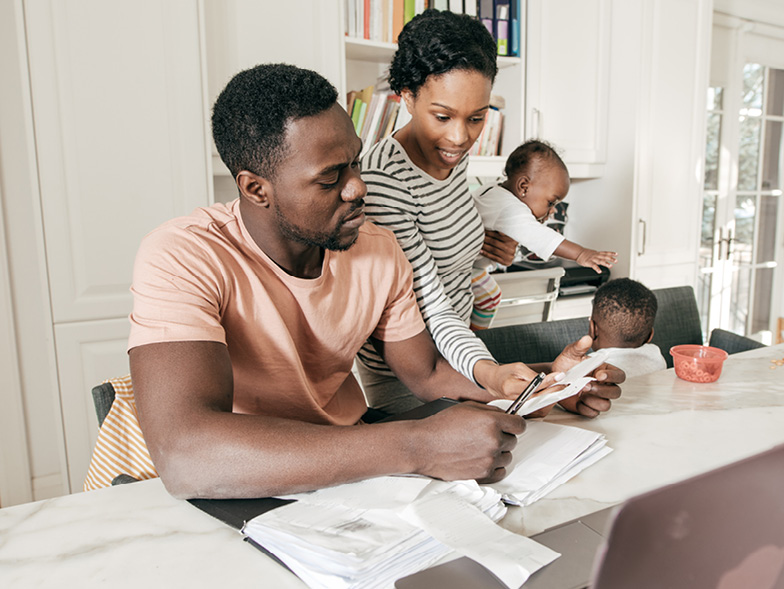

Budgeting Tips for a Larger Purchase

There are dozens of ways to craft a budgeting plan, though it differs depending on what it is you’re budgeting for. Smaller purchases, while still requiring self-control, are a little easier to budget for than things like a vacation, a new home, or a new car. Here are some steps you can take to account for bigger purchases later on.

Make a list of priorities.

There are probably some things you can easily cut out of your daily spending habits—making coffee runs, eating out for lunch, and perusing online shops. Think about all those purchases that can be cut out, then make a list of what your priorities are. What weekly or monthly payments do you need to account for? Is there a purchase you need to make in the next six months to a year, compared to those you just want to make? If you figure out what’s most important, you’ll be able to make the adjustments to help you budget.

Set up your savings account.

If you already have a savings account, great! You’re that much closer to streamlining your budget. If you don’t, that’s an easy first step you could make to kick off your budgeting journey. Decide how much you want to contribute to this account on a monthly basis, or increase the amount if you already contribute regularly.

Put away extra money.

This could mean putting away anything from checks you receive on your birthday to an end-of-year bonus. It’s tempting to spend this extra money on a new outfit or expensive dinner, but try to remember that putting it away in savings for a larger purchase will have more reward in the long run.

Check your accounts frequently.

If keeping an eye on your checking and savings accounts stresses you out in the moment, that’s all the more reason for you to be checking them more often. It’s easy to forget about all those little purchases you make if you aren’t seeing the money come out of your account! If you normally wake up and check Facebook and Twitter, add your bank account(s) to that list too, and make sure you know where your finances stand.

Download a helpful app.

Deciding you need some extra help to save isn’t a weakness. It could actually be the reason you end up saving at all. Consider Qapital, which makes saving a breeze, Wally, which practically creates and manages your budget for you, or Clarity, an app that helps you grow your savings by ridding you of any unnecessary recurring payments.

Try the 50/20/30 rule.

Following this rule may be the guidebook you need. It states that you spend 50 percent of what you earn on necessities (groceries, rent, mortgage, etc.), put 20 percent toward savings, and leave 30 percent for things like gym memberships and eating out with your friends. Follow this rule, and watch your savings grow before you know it.